Which of the Following Best Describes a Subsidy

The amount added to the members monthly plan premium if they did not enroll in a Medicare Advantage plan with Part D benefits or stand-alone prescription drug plan when they were first eligible for Medicare Parts A andor B or went without creditable prescription drug. Which of the following provides for a state subsidy to any county or group of counties that chooses to develop its own community corrections system.

4 7 Taxes And Subsidies Principles Of Microeconomics

A debit to the Subsidy from National Government account d.

. B It is the general description of a type of thing. It is an attribute of a class. Farmers pay the government 100 per ton of wheat produced.

A subsidy essentially lowers the prices of foreign goods rather than raising the p. Which of the following best describes a subsidy. Which of the following best describes an object.

It is a financial assistance given. B A subsidy essentially raises the prices of domestic goods rather than lowering the prices of foreign goods. Which of the following statements best describes the various Registries maintained by government entities.

The document has moved here. The government pays farmers 100 per ton of wheat produced. 3 on a question Which of the following best describes a subsidy.

Banks make low-interest loans to farmers. Banks make low-interest loans to farmers. Which of the following best describes a subsidy.

Banks make low-interest loans to farmers. Which of the below option best describes the process of insurance. Which of the following correctly describes a subsidy.

Banks make low-interest loans to farmers. A debit to the Due to BIR account e. It keeps the price of domestic goods relatively low.

Banks make low-interest loans to farmers. The government pays farmers 100 per ton of wheat produced. The receipt of Notice of Cash Allocation is recorded in the a.

The government puts a tax of 100 per ton on wheat imports. Course Title ECON 101. Which of the following statements is incorrect regarding the accounting for unreleased.

Sharing the losses of few by many C. The government puts a tax of 100 per ton on wheat imports. Books of accounts Journal and Ledger b.

All of these are included. A A subsidy essentially lowers the prices of foreign goods rather than raising the prices of domestic goods. It is a financial assistance given by government to reduce wheats price in markets.

The government pays farmers 100 per ton of wheat produced. Which of the following best describes the Late Enrollment Penalty LEP. Which of the following best describes a subsidy.

It encourages the import of foreign goods. Banks low interest rate to farmers is just credit ease policy. 3 question Which best describes what a subsidy does.

3 question Which of the following best describes a subsidy. Government paying farmers 100 tone per wheat produced is a subsidy as. Which of the below option best describes the process of insurance.

Farmers pay the government 100 per ton of wheat produced. The subsidy lowers the prices of domestic goods rather than raising the prices of foreign goods. Which of the following best describes a subsidy.

The best example of a subsidy is when a farmer gets a lump sum of money from the government for keeping their land a certain way. Describes a Subsidy Draga propriate wers here CHA a way of making consumption cost-free a means of internalizing positive externalities a consumption incentive Form Qui tax on producers Dragovorare curre Does Not Describe a Subsidy. The government will pay farmers who keep certain weeds or crops on their land instead of mowing it.

The government puts a tax of 100 per ton on wheat imports. The government puts a tax of 100 per ton on wheat imports. Economics questions and answers.

Subsidy is grant financial aid given by government to producers of a commodity to enable its availability in markets at a lower price. Sharing of losses through subsidy Answer. Government paying farmers 100 tone per wheat produced is a subsidy as.

Sharing the losses of many by a few B. Farmers pay the government 100 per ton of. Subsidy is grant financial aid given by government to producers of a commodity to enable its availability in markets at a lower price.

It is a method of a class. The Registries primarily serve as an internal control for controlling and monitoring the conformance of actual results with the approved budget. Signin with Facebook Signin with Google.

Which of the following best describes the Notice of Cash Allocation NCA. Concept taxation and subsidy 18 which of the. Which of the following is the best known and largest mentoring program in the nation.

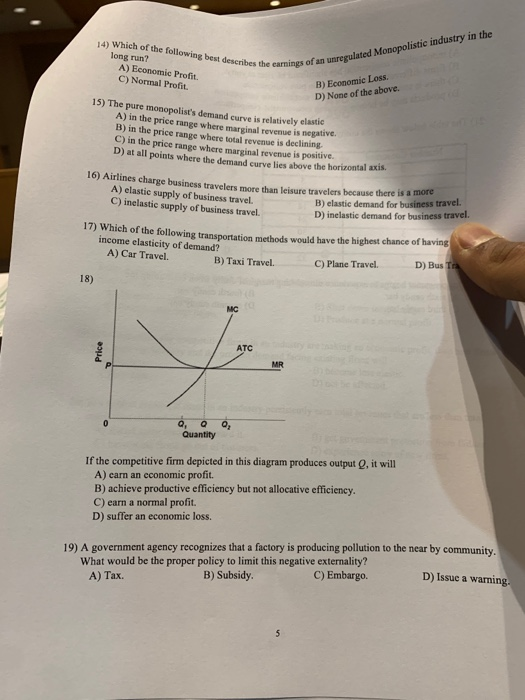

Pages 11 This preview shows page 9 - 11 out of 11 pages. Which best describes what a subsidy does. CONCEPT Taxation and Subsidy 18 Which of the following best describes.

C A subsidy is a government payment to help a domestic business compete with foreign firms. Answered Which of the following statements best describes the effects of subsidies. One sharing the losses of few.

Get ready for the biggest online educational platform. It keeps the price of domestic goods relatively low It raises the price of imported goods It limits the import of foreign goods It eliminates all taxes on domestic goods. It is a specific instance of a class.

It raises the price of imported goods. The government puts a tax of 100 per ton on wheat imports.

4 7 Taxes And Subsidies Principles Of Microeconomics

Solved 14 Which Of The Following Best Describes The Coming Chegg Com

No comments for "Which of the Following Best Describes a Subsidy"

Post a Comment